🧠 The Importance of Earnings

|

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <3 minutes

Friends, Tell us if you've heard this pithy line before: If you missed the best 30 days of stock market returns over the past three decades, your returns would have been obliterated. There's data to back that up. Here's the evidence Hartford Funds offered its clients. The spirit of this message is on point: don't sell when there's volatility. But beginner investors walk away missing two very important caveats:

Here's the missing piece for long-term investors: nothing drives stock prices more than results. Investors also get the most information about results during earnings season. Thus, if you're looking for a time when your investments will gradually become decoupled from the market—in a good way—look no further than earnings season. We don't think anyone should freak out or rejoice over one earnings report, but we do think this is where there is real evidence that can battle-test your original investing thesis. Wishing you investing success, - Brian Feroldi, Brian Stoffel, & Brian Withers P.S. Need help analyzing a company's quarterly results? Check out this YouTube video we made on how we review quarterly earnings. One Simple Graphic: One Piece of Timeless Content: Morgan Housel helps investors develop a beneficial mindset about investing in an easy-to-understand and memorable way. In one of his recent blog posts, Lucky versus Repeatable, he defines luck in a way you've never thought about before and ties it to investing. One Thread:

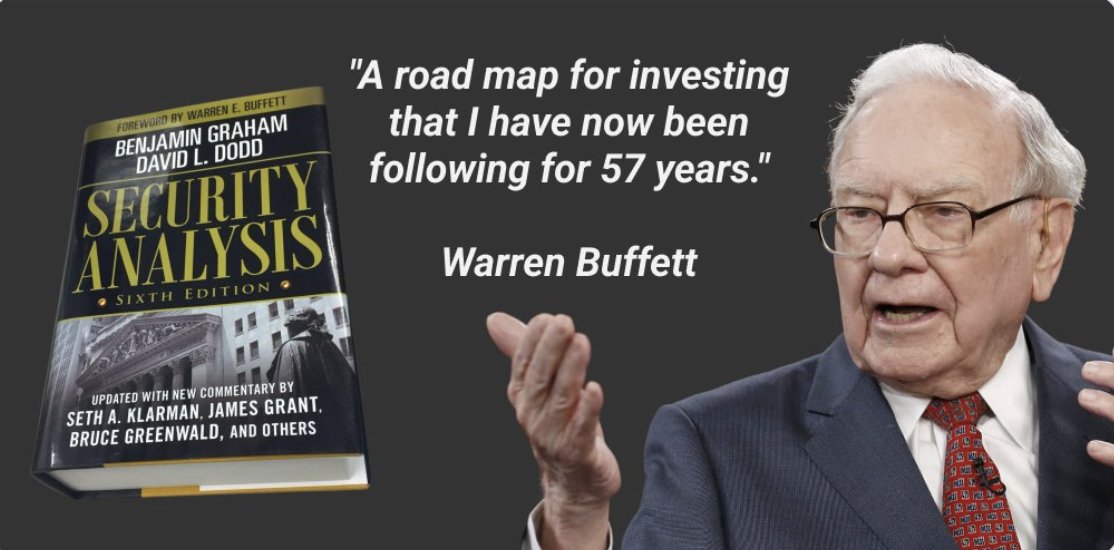

One Resource: Did you miss the Berkshire Hathaway shareholder meeting? It was live-streamed on CNBC, along with an article that included live updates of the most interesting moments of the five-plus-hour Q&A session. One Quote: 👋 What did you think of today's newsletter? More From Us: 📗 If you've read Brian Feroldi's book, he'd love a review. 👨🎓 Interested in learning to read financial statements like Warren Buffett? Check out our self-paced course, The Buffett Method. 🎬 Want a review of popular company earnings? Check out our YouTube channel! Cloudflare, Apple, & MercadoLibre earnings videos are now available! |

Long-Term Mindset

I teach investors how to analyze businesses. Each Wednesday, I share six pieces of timeless content that can be read in less than 2 minutes. Read by 100,000+ investors from a16z, Amazon, Google, Microsoft, and more.

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson:How about that weather? Timeless Content: Why you can't time the market Stock Dive: A full breakdown of Mastercard Incorporated Resource: AI Predictions for 2026 And more! Which stock should we research live next? Next Tuesday (Feb 3rd) at 12:00 PM (Noon) EST, we'll research a stock live, and we want you to pick the stock. Which...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Your life -- in 24 hours Timeless Content: 6 Ways to Improve Your Investing Process Stock Dive: A full breakdown of Meta Platforms Resource: AI Lessons From the Front Lines And more! Which stock should we research live next? Software stocks have been crushed in 2026. We smell opportunity. Next Tuesday (January 27th) at 12:00 PM...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: A parable from American football Timeless Content: Companies quietly beating the market Stock Dive: A full breakdown of lululemon athletica inc. Resource: AI Will Not Make You Rich And more! Join Us For A Free Investing Masterclass: Join us next Tuesday (Jan 20th) at 12:00 PM EST for an investing masterclass: AI Bubble Stress Test:...